The Rising Popularity of Gold IRAs: A Secure Funding for the Future

페이지 정보

본문

Lately, the financial landscape has seen a major shift as more buyers seek to diversify their portfolios and protect their wealth from financial uncertainties. One funding vehicle that has gained considerable consideration is the Gold Individual Retirement Account (IRA). This article explores the idea of Gold IRAs, their benefits, potential drawbacks, and the strategy of setting one up, providing a complete overview for those contemplating this various funding possibility.

What is a Gold IRA?

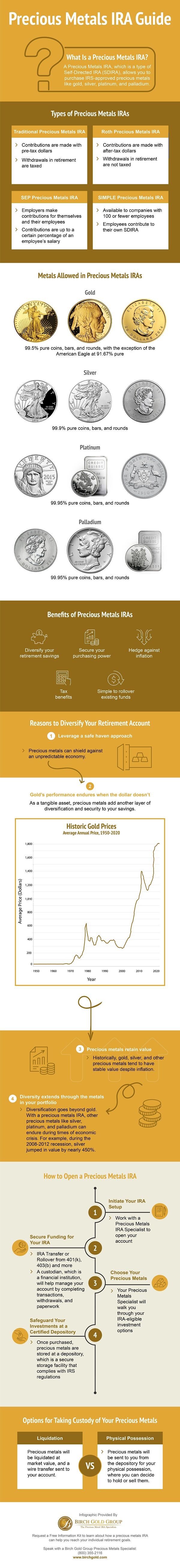

A Gold IRA is a type of self-directed particular person retirement account that enables traders to hold physical gold, as well as different precious metals, as part of their retirement savings. Not like traditional IRAs that sometimes consist of stocks, bonds, and mutual funds, secure gold ira options for beginners Gold IRAs provide a unique opportunity to invest in tangible belongings. This can be notably appealing throughout instances of financial instability, inflation, or foreign money devaluation.

The benefits of Gold IRAs

- Inflation Hedge: Certainly one of the first advantages of investing in gold is its historical position as a hedge against inflation. Here is more about secure gold ira options for beginners (http://www.liberte-de-conscience-rideuromed.org/forum-déchanges/profile/roseannaraujo20/) check out the web-page. As the worth of fiat currencies declines over time, gold has maintained its purchasing power, making it a horny possibility for preserving wealth.

- Portfolio Diversification: Gold IRAs permit traders to diversify their retirement portfolios past conventional assets. By including bodily gold, buyers can scale back total portfolio risk and improve potential returns, as gold typically moves inversely to inventory market developments.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that investors can hold in their hands. This tangibility can provide peace of mind, particularly during durations of economic uncertainty when confidence in monetary establishments might wane.

- Tax Benefits: Gold IRAs offer the same tax benefits as traditional IRAs. Contributions may be tax-deductible, and the expansion of the investment is tax-deferred till withdrawal. This can lead to vital tax financial savings over time.

- Safety Against Forex Fluctuations: Gold is a world foreign money that isn't subject to the identical fluctuations as national currencies. This could present a safeguard towards geopolitical risks and forex devaluation, guaranteeing that traders maintain their buying power.

Potential Drawbacks of Gold IRAs

Despite their many benefits, Gold IRAs will not be without drawbacks. Buyers ought to bear in mind of the following potential challenges:

- Storage and Security Costs: Bodily gold have to be saved securely, which usually incurs extra costs. Buyers may need to pay for secure storage amenities, insurance coverage, and safety measures, which may eat into overall returns.

- Restricted Liquidity: While gold is a worthwhile asset, it might not be as liquid as stocks or bonds. Promoting bodily gold can take time and may involve extra charges, which could impression an investor's potential to entry funds rapidly.

- Market Volatility: Though gold is often seen as a stable investment, its worth can nonetheless fluctuate attributable to market conditions, geopolitical events, and secure gold ira options for beginners adjustments in investor sentiment. This volatility can pose risks for buyers who aren't prepared for worth swings.

- Regulatory Concerns: Gold IRAs are topic to specific IRS rules regarding the sorts of gold and valuable metals that can be held. Buyers must ensure compliance with these laws to keep away from penalties or disqualification of their IRA.

Organising a Gold IRA

For these fascinated by establishing a Gold IRA, secure gold ira options for beginners the process involves several key steps:

- Select a Custodian: Step one is to pick a reputable custodian who focuses on self-directed IRAs and has expertise with valuable metals. The custodian will handle the administrative duties, together with account setup, file-protecting, and compliance with IRS laws.

- Fund the Account: Investors can fund their Gold IRA by various means, including rolling over funds from an existing retirement account, making direct contributions, or transferring property from another IRA. It's essential to consult with a financial advisor to find out the very best funding strategy.

- Choose Accepted Precious Metals: Once the account is funded, investors can choose from a range of accredited treasured metals, together with gold bullion, gold coins, silver, platinum, and palladium. The IRS has specific necessities relating to the purity and varieties of metals that can be held in a Gold IRA.

- Buy and Store the Metals: After selecting the specified valuable metals, the custodian will facilitate the purchase and arrange for safe storage in an approved depository. It is crucial to ensure that the storage facility meets IRS standards and supplies enough security.

- Monitor and Manage the Investment: Buyers should repeatedly evaluation their Gold IRA holdings and general funding technique. This may occasionally involve rebalancing the portfolio, assessing market conditions, and making knowledgeable selections about shopping for or promoting precious metals.

Conclusion

Gold IRAs present a compelling possibility for investors seeking to diversify their retirement portfolios and protect their wealth from financial uncertainties. With their potential for lengthy-time period progress, inflation hedging capabilities, and tax advantages, Gold IRAs can function a invaluable addition to an investment technique. Nevertheless, potential buyers should rigorously consider the related costs, market volatility, and regulatory requirements before diving in. As with every funding, conducting thorough research and consulting with monetary professionals may help individuals make informed decisions that align with their financial goals and danger tolerance. As the monetary panorama continues to evolve, Gold IRAs might increasingly turn out to be a cornerstone for these trying to safe their financial future.

- 이전글Understanding Guaranteed Loan Approval with No Credit Check 25.08.05

- 다음글The No. 1 Question That Anyone Working In Window And Door Companies Near Me Should Be Able To Answer 25.08.05

댓글목록

등록된 댓글이 없습니다.