Things You won't Like About Gold Price Analysis And Things You'll

페이지 정보

본문

Q3’21 got here in close to the latter couple, not removed from being the third-finest ever witnessed. The Alaska Mint at the moment holds the distinction of being the northernmost mint or refiner within the United States. And so, it is always vital to only work with respectable vendors at all times. Janet Maslin of The brand new York Times called the movie one "so badly bungled that it can't assist but rivet the viewers's consideration" whereas citing its ineffective casting and direction. While that heavy-to-extreme gold-futures selling on Fed-tightening fears pounded gold 9.6% lower from early June to late September, most of that occurred in June. Last quarter gold just edged a trivial 0.8% lower! It's going to reveal how gold funding demand fared last quarter within the face of that heavy gold-futures selling. The one potential for appreciation is that if there is a jump in costs that permits you to sell at a profit (and even that may be compromised by the point, effort, and varied assessment prices that accompany selling).

Q3’21 got here in close to the latter couple, not removed from being the third-finest ever witnessed. The Alaska Mint at the moment holds the distinction of being the northernmost mint or refiner within the United States. And so, it is always vital to only work with respectable vendors at all times. Janet Maslin of The brand new York Times called the movie one "so badly bungled that it can't assist but rivet the viewers's consideration" whereas citing its ineffective casting and direction. While that heavy-to-extreme gold-futures selling on Fed-tightening fears pounded gold 9.6% lower from early June to late September, most of that occurred in June. Last quarter gold just edged a trivial 0.8% lower! It's going to reveal how gold funding demand fared last quarter within the face of that heavy gold-futures selling. The one potential for appreciation is that if there is a jump in costs that permits you to sell at a profit (and even that may be compromised by the point, effort, and varied assessment prices that accompany selling).

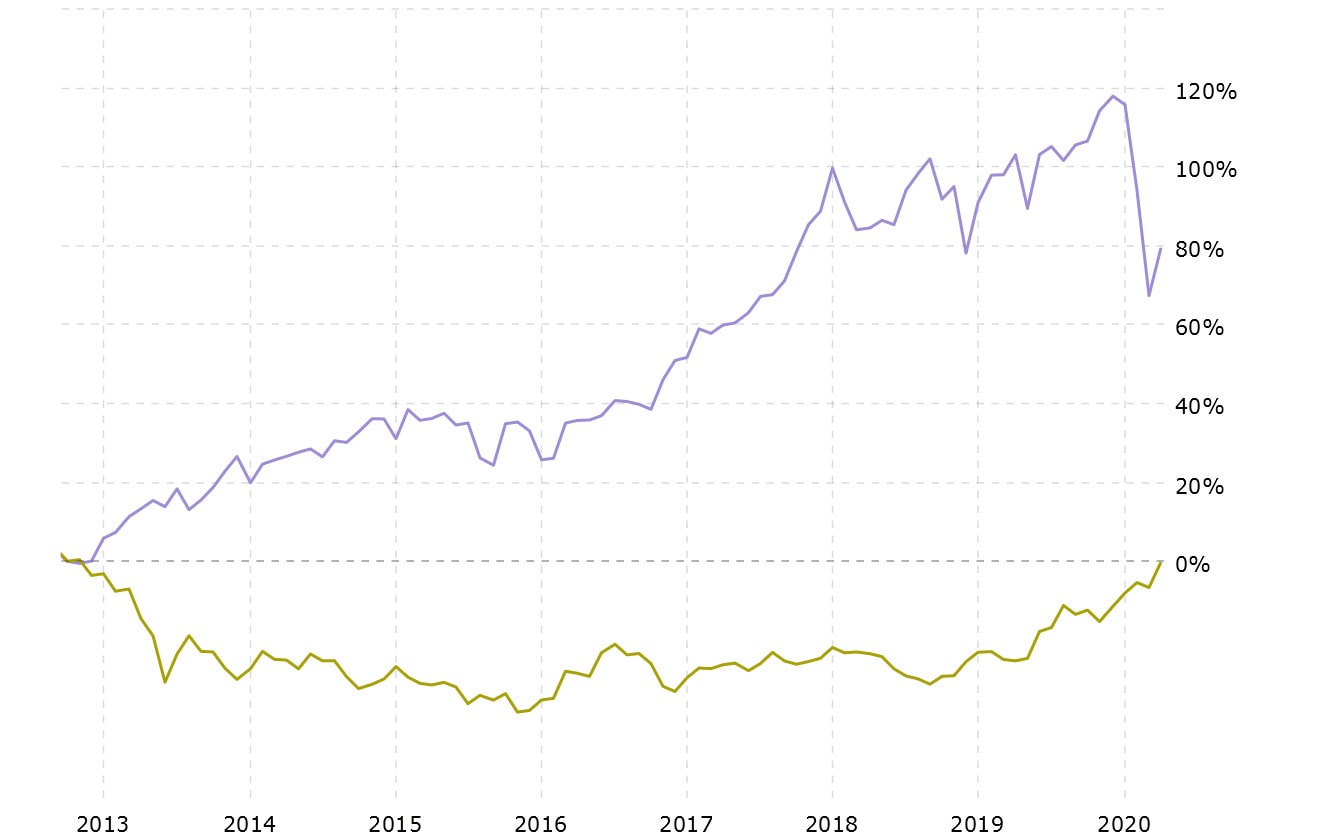

Such colossal earnings would gasoline revenue margins of 42%, lofty levels most industries would die for. And those all-in sustaining costs are inversely correlated with miners’ output ranges. So these three variables of quarterly average gold costs together with gold miners’ seemingly common costs and manufacturing levels are enough to predict how their latest outcomes ought to look. After each quarterly earnings season, I dig through the newest outcomes from the highest 25 GDX and GDXJ gold miners. I analyzed the GDX high 25’s Q2’21 fundamentals in a mid-August essay. So odds are the upcoming Q3’21 outcomes from the GDX gold miners will reveal comparable AISCs. And amazingly the gold miners’ earnings will likely prove even greater as soon as their Q3’21 results are in and collated. Their key numbers are fed into a mammoth spreadsheet for data crunching and analysis, then I write essays summarizing the outcomes. The World Gold Council publishes one of the best-available worldwide gold elementary data in its excellent quarterly Gold Demand Trends stories. One frequent theme caught out a pair months ago when I was wading via Q2’21 studies.

Such colossal earnings would gasoline revenue margins of 42%, lofty levels most industries would die for. And those all-in sustaining costs are inversely correlated with miners’ output ranges. So these three variables of quarterly average gold costs together with gold miners’ seemingly common costs and manufacturing levels are enough to predict how their latest outcomes ought to look. After each quarterly earnings season, I dig through the newest outcomes from the highest 25 GDX and GDXJ gold miners. I analyzed the GDX high 25’s Q2’21 fundamentals in a mid-August essay. So odds are the upcoming Q3’21 outcomes from the GDX gold miners will reveal comparable AISCs. And amazingly the gold miners’ earnings will likely prove even greater as soon as their Q3’21 results are in and collated. Their key numbers are fed into a mammoth spreadsheet for data crunching and analysis, then I write essays summarizing the outcomes. The World Gold Council publishes one of the best-available worldwide gold elementary data in its excellent quarterly Gold Demand Trends stories. One frequent theme caught out a pair months ago when I was wading via Q2’21 studies.

That month alone as speculators cowered in fear at possibly seeing two little quarter-point price hikes over a pair years into the future, over 3/4ths of gold’s whole recent-months selloff accrued. That ought to materialize once more as Q3’21 is reported over this next month or so. Of course June was the final month of Q2’21, the place gold still averaged $1,814. In the simply-completed third quarter of 2021, gold averaged $1,789 on shut. But to be conservative, assume sequential progress last quarter is available in just over half the worldwide decade-lengthy common at 3.5%. From studying the quarterlies and press releases I think the actual Q2-to-Q3 growth will prove larger, however 3.5% is easy to defend for a preview. That may make for a very-worthwhile quarter regardless of the wailing and gnashing of teeth. As with all funding decision, careful analysis, and consideration of your monetary objectives are important to make informed decisions that align together with your risk tolerance and long-time period objectives. Unlike another investment options, gold has been traditionally known to maintain its value.

Very similar to coin collecting, the value of a stamp is decided by rarity, condition, and demand. Gold collector coins have a price that’s above their gold content material. Sequentially quarter-on-quarter in Q3’21, the typical gold worth merely slumped 1.4%. And goofy traders nonetheless cried the sky is falling. Earlier in May, RBC Capital set a worth target of $forty three on KL inventory, rating it as a ‘Buy’. The wider market mood and the price behavior of yields will likely be attentively monitored all through the day to place new wagers on the gold value. Quite the opposite, events just like the inventory market crash of 2008 or the "flash crash" of 2010 suggest that world shipping’s deeper integration with financial markets could introduce one other layer of instability. As I find gold mining actually interesting, I really like reading quarterlies. Conversely, during durations of financial uncertainty or recessionary pressures when investors search safer investments to guard their wealth from market volatility, demand for price precious metals like silver tends to increase. Precious metals invested in a self-directed IRA must be stored in an approved depository, such because the Delaware Depository. That manner, you may determine whether or not a gold IRA is a good idea in your monetary plan.

- 이전글What Are you Able to Do To Avoid Wasting Your Gold Mining Stocks From Destruction By Social Media? 24.12.04

- 다음글Choosing Invest In Gold Is Easy 24.12.04

댓글목록

등록된 댓글이 없습니다.