Case Study: Quick Money Order Chicago 55th St IL

페이지 정보

본문

Introduction

In the early 2000s, Quick Money Order emerged as a significant player in the financial services sector, particularly in the Chicago area. This case study explores the establishment, growth, challenges, and impact of Quick Money Order located on 55th Street in Chicago, Illinois. By examining its business model, target market, and operational strategies, we aim to understand how Quick Money Order navigated the complexities of the financial landscape during this period.

Background

The Financial Landscape in the Early 2000s

The early 2000s were marked by a rapidly changing financial environment in the United States. The aftermath of the dot-com bubble burst, coupled with the looming threat of recession, created a challenging atmosphere for traditional banking institutions. Consumers, particularly those from lower-income backgrounds, sought alternative financial services that provided quick access to cash without the stringent requirements of conventional banks.

Quick Money Order's Foundation

Founded in 1999, Quick Money Order was established by a group of financial entrepreneurs who recognized the demand for quick and accessible financial services in underserved communities. The 55th Street location was strategically chosen due to its proximity to residential neighborhoods and small businesses, which would become their primary clientele.

Business Model

Services Offered

Quick Money Order specialized in a variety of financial services, including:

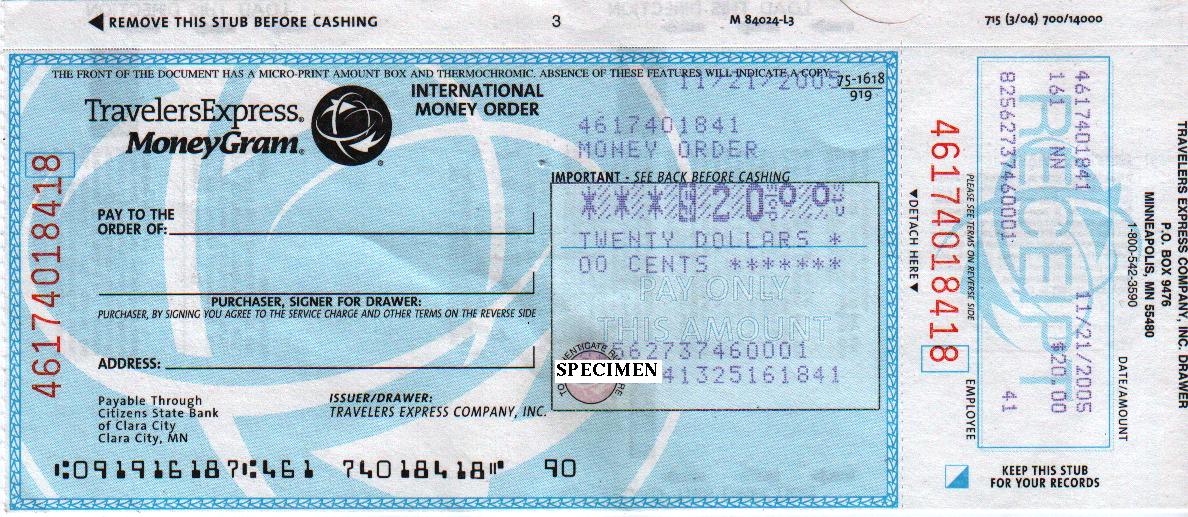

- Money Orders: Providing a secure and convenient way for customers to send money without needing a bank account.

- Check Cashing: Allowing individuals to cash their checks quickly, often without the need for identification or a bank account.

- Payday Loans: Offering short-term loans that catered to individuals in need of immediate cash.

- Money Transfers: Facilitating remittances for customers sending money to family and friends domestically and internationally.

Target Market

The primary target market for Quick Money Order consisted of low to middle-income individuals, many of whom were unbanked or underbanked. This demographic included:

- Young professionals seeking immediate cash for unexpected expenses.

- Families needing to send money to relatives in other states or countries.

- Small business owners requiring quick access to funds for operational needs.

Pricing Strategy

Quick Money Order adopted a competitive pricing strategy to attract customers. Their fees for services such as check cashing and money orders were lower than those of traditional banks and other financial service providers. This pricing strategy was crucial for drawing in clients who were sensitive to costs.

Growth and Expansion

Initial Success

In its early years, Quick Money Order experienced rapid growth. The combination of a strategic location, comprehensive service offerings, and competitive prices allowed the business to establish a loyal customer base. Word-of-mouth referrals played a significant role in attracting new clients, as satisfied customers shared their positive experiences with friends and family.

Marketing Strategies

To further enhance its visibility, Quick Money Order employed various marketing strategies, including:

- Community Engagement: Participating in local events and Order Express sponsoring community initiatives helped build brand awareness and fostered goodwill among residents.

- Promotions and Discounts: Offering limited-time promotions, such as reduced fees for money orders, attracted new customers and encouraged repeat business.

- Partnerships: Collaborating with local businesses and organizations allowed Quick Money Order to reach a broader audience and provide tailored services to specific groups.

Challenges Faced

Regulatory Environment

As Quick Money Order grew, it faced increasing scrutiny from regulatory bodies. The financial services industry was becoming more heavily regulated, particularly concerning payday lending practices. This posed challenges for Quick Money Order, as compliance with new regulations required adjustments to their business model.

Competition

The rise of online financial services and the increasing number of brick-and-mortar competitors posed a threat to Quick Money Order’s market share. Larger financial institutions began offering similar services, often with more resources to invest in marketing and technology.

Economic Factors

The economic downturn in the early 2000s also impacted Quick Money Order. As unemployment rates rose and disposable incomes fell, the demand for financial services fluctuated. While some customers sought quick cash due to financial hardships, others became more cautious about borrowing money.

Adaptation and Resilience

Embracing Technology

In response to the challenges posed by competition and regulatory changes, Quick Money Order began to embrace technology. They launched an online platform that allowed customers to access services such as money transfers and Order Express loan applications from the comfort of their homes. This move not only improved customer convenience but also helped Quick Money Order stay relevant in an increasingly digital world.

Diversification of Services

To mitigate risks associated with reliance on a single service, Quick Money Order diversified its offerings. They introduced new products, such as prepaid debit cards and financial literacy workshops, aimed at empowering customers with better financial management skills. This diversification helped attract a broader customer base and provided additional revenue streams.

Strengthening Customer Relationships

Quick Money Order placed a strong emphasis on customer service. They trained staff to provide personalized assistance and fostered a welcoming environment in their physical locations. Building strong relationships with customers contributed to high levels of customer retention and loyalty, even in the face of competition.

Impact on the Community

Economic Empowerment

Quick Money Order played a vital role in the economic empowerment of the local community. By providing access to financial services that were otherwise unavailable, they enabled individuals and families to manage their finances more effectively. This access helped many customers avoid predatory lending practices and build a more stable financial future.

Job Creation

As Quick Money Order Express expanded its operations, it contributed to job creation in the local economy. The company hired staff from the community, providing employment opportunities and contributing to the overall economic development of the area.

Financial Literacy

Through workshops and community outreach programs, Quick Money Order Express promoted financial literacy among its customers. By educating individuals about budgeting, saving, and responsible borrowing, they empowered clients to make informed financial decisions and improve their economic situations.

Conclusion

Quick Money Order on 55th Street in Chicago exemplifies the resilience and adaptability of a small financial service provider in a challenging economic landscape. Through strategic marketing, diversification of services, and a strong commitment to customer service, Quick Money Order not only survived but thrived during the early 2000s. Its impact on the community, particularly in terms of economic empowerment and financial literacy, highlights the importance of accessible financial services in fostering economic stability. As the financial landscape continues to evolve, Quick Money Order's legacy serves as a testament to the potential of small businesses to effect positive change in their communities.

- 이전글❤️✅░NEW 오 피 출 장░✅❤️전원 한국인⏩S+급 여대생⏩100% 리얼 실 사❄️S클래스 라인❄️최상의 퀄리티☪️다양한 옵션☪️재방문 맛집✨거품욕장✨업계1위❤️와 꾸❄️몸 매❄️슬 25.10.04

- 다음글Play m98 Gambling establishment Online in Thailand 25.10.04

댓글목록

등록된 댓글이 없습니다.