The Anthony Robins Information To Gold ETFs

페이지 정보

본문

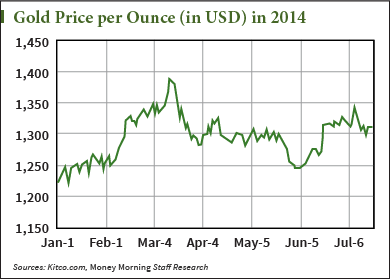

The ability of this force is readily apparent above. Without the bond and stock panics, I believe gold would have had no drawback at all staying in the $900s or at least above its high-consolidation help line rendered here. If inventory investors purchase GLD shares at a faster charge than gold is being bought, this ETF’s custodians should subject more shares to keep GLD from decoupling from the gold price now worth to the upside. A strong world gold price usually interprets into higher local prices, whereas a weaker international value often results in decrease local prices. Gold is the final word cash, the mortal nemesis of all of the fiat-paper currencies worldwide. A high-volume and highly liquid GLD choices market has additionally sprung up, offering more subtle traders with wonderful instruments to take advantage of projected gold strikes through stock choices. Every dollar s price of other vendible property in the world has exactly the same amount of true and natural market value as has a dollar in coin. Note the sharp recent decline in the USDX in July that "just happened" to start out right when the SPX began rallying sharply off 880. Everything we’ve seen since early March strongly suggests that the continuing restoration in stock costs will continue to weigh on the US dollar.

The ability of this force is readily apparent above. Without the bond and stock panics, I believe gold would have had no drawback at all staying in the $900s or at least above its high-consolidation help line rendered here. If inventory investors purchase GLD shares at a faster charge than gold is being bought, this ETF’s custodians should subject more shares to keep GLD from decoupling from the gold price now worth to the upside. A strong world gold price usually interprets into higher local prices, whereas a weaker international value often results in decrease local prices. Gold is the final word cash, the mortal nemesis of all of the fiat-paper currencies worldwide. A high-volume and highly liquid GLD choices market has additionally sprung up, offering more subtle traders with wonderful instruments to take advantage of projected gold strikes through stock choices. Every dollar s price of other vendible property in the world has exactly the same amount of true and natural market value as has a dollar in coin. Note the sharp recent decline in the USDX in July that "just happened" to start out right when the SPX began rallying sharply off 880. Everything we’ve seen since early March strongly suggests that the continuing restoration in stock costs will continue to weigh on the US dollar.

By the time this sharp gold recovery lastly took a breather in late February, this metallic had soared almost 40% in just over three months. Such a fast return to pre-panic ranges underscores the fact that gold’s panic weakness was a total anomaly, a cruel but in the end irrelevant twist of destiny driven by panicky market forces far larger than the gold market. This makes MCX the perfect in service provision for stock and commodity market. While it’s beyond the scope of this essay to fully develop inventory capital’s influence on gold by way of this GLD conduit, I can be remiss in not mentioning it in an essay concerning the SPX driving gold. The SPX is driving gold! And if gold’s behavior relative to the USDX since last summer time is any indication, additional dollar weakness might be very bullish for gold. Carefully examine gold’s habits relative to the USDX’s between mid-July to mid-November. The USDX’s main affect on gold over the previous year has important close to-time period implications for gold traders. Now that it's crystal clear what drove the USDX through the inventory panic, consider the USDX’s affect on gold. 925 to $975 was regular before the panic, and now that the panic is gone these similar ranges are normal again.

So the vary between $925 and $975 was a righteous pre-panic degree for gold. Previous to the bond panic, the USDX was languishing around seventy two to 73. Since stocks bottomed in early March, the USDX has been quickly falling again down in direction of these pre-panic levels. So odds are the USDX won’t cease for long in its pre-panic pattern, however grind even decrease. Because of this trend, I actually doubt the USDX will stop close to 78 at present as Wall Street hopes. But the chilly, onerous actuality is the dollar’s fundamentals right now are radically worse than they had been last summer. These panic-pushed developments are flooding the world with new dollars at a time when interest charges are far too low to make it a pretty currency. Everything below this help line was just a panic-driven anomaly. When such systemic occasions occur, some investors look to purchase safe-haven belongings which are uncorrelated or negatively correlated to the overall market throughout occasions of distress. Market View Mobile is effectively designed and features a user-friendly interface. IRAs can consist of supplies, bonds, and in addition some rare-earth component bullion, like platinum in addition to palladium. Diamond Bullion, produced by the Singapore Diamond Mint, is a collection of funding grade diamonds whose worth could be shortly checked.

If you beloved this write-up and you would like to obtain more details with regards to سعر الذهب اليوم في الكويت kindly go to our own web site.

- 이전글Secrets Your Parents Never Told You About Gold Mining Stocks 25.01.05

- 다음글Exploring High-Income Night Jobs: Your Guide to Lucrative Opportunities 25.01.05

댓글목록

등록된 댓글이 없습니다.